EUR/GBP Price Analysis: Clings to intraday gains near 0.8630 region, bullish bias remains

- EUR/GBP regained positive traction on Tuesday and recovered a part of the overnight losses.

- The set-up seems tilted in favour of bullish traders and supports prospects for additional gains.

- A sustained break below the 0.8565 region is needed to negate the near-term positive outlook.

The EUR/GBP cross edged higher through the mid-European session and refreshed daily tops, around the 0.8635 region in the last hour. The momentum allowed the cross to recover a part of the previous day's losses to sub-0.8600 levels, or near two-week lows.

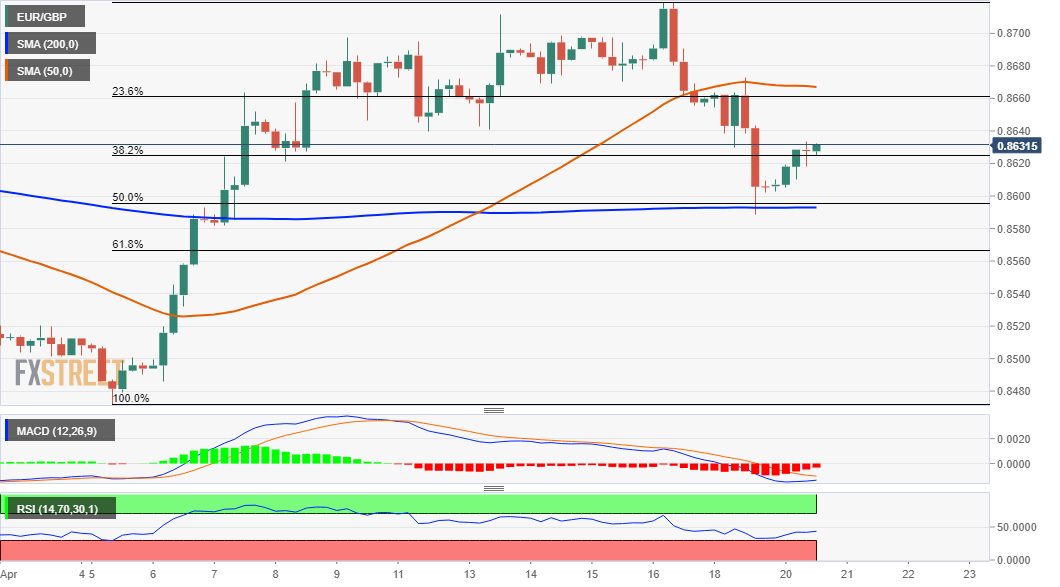

The mentioned handle marked a confluence region comprising of 100-period SMA on the 4-hour chart and the 50% Fibonacci level of the 0.8472-0.8719 strong recovery move from over one-year lows. This should now act as a key pivotal point for short-term traders.

Meanwhile, technical indicators on the daily chart – though have been losing positive momentum – are still holding in the positive territory. This, along with the emergence of some dip-buying on Tuesday, supports prospects for a further near-term appreciating move.

From current levels, any subsequent positive move might confront resistance near the 0.8660 area, marking the 23.6% Fibo. level and 50-period SMA confluence. A sustained move beyond will reaffirm the constructive outlook and push the cross back above the 0.8700 mark.

This is closely followed by the recent swing highs, around the 0.8715-20 region. Some follow-through buying has the potential to lift the EUR/GBP cross to the 0.8740-50 supply zone, above which bulls might aim to reclaim the 0.8800 mark for the first time since early February.

On the flip side, the 0.8600-0.8590 region now seems to have emerged as immediate strong support. A convincing break below will negate any near-term positive bias and turn the EUR/GBP cross vulnerable to test the 61.8% Fibo. level support near the 0.8565 region.

Failure to defend the mentioned support levels would expose the key 0.8500 psychological mark before the EUR/GBP cross eventually drops to challenge YTD lows, around the 0.8470 region.

EUR/GBP 4-hour chart

Technical levels to watch